The outlook for healthcare insurance in Alabama is looking up. Premiums are dropping, and about 95% of enrollees who use the marketplace exchange receive premium subsidies.

Even though Alabama hasn’t accepted the expansion of Medicaid, a single person needs to earn a manageable $12,490 to begin qualifying for premium subsidies. These details keep health insurance plans and coverage in Alabama fairly consistent from one year to the next, protecting almost all enrollees.

What are my Options for Purchasing Health Insurance in Alabama

Purchasing affordable health insurance coverage in Alabama is not just about finding the cheapest plan. It’s about accurately assessing your health needs, anticipating where you may need medical coverage in the future (for example, the chances of needing hospital stays, testing, or prescription drugs), and how frequently you may need to use these services.

Your first option is to use a health exchange to find appropriate ACA-compliant health plans. These plans align with the Affordable Care Act, and, as such, offer minimum essential coverage. “MEC” includes hospitalization services, pregnancy care, prescription drug coverage, and even mental health and substance use disorder support services.

These plans can help cover individual, family, and short term healthcare costs.

1) Alabama Marketplace Health Insurance Plans (ACA)

ACA health insurance plans are the most popular option for purchasing health insurance in Alabama. For the most part, if you’re an employee in a company of a particular size, you’ll gain access to group health insurance, which is a form of employer-sponsored health coverage.

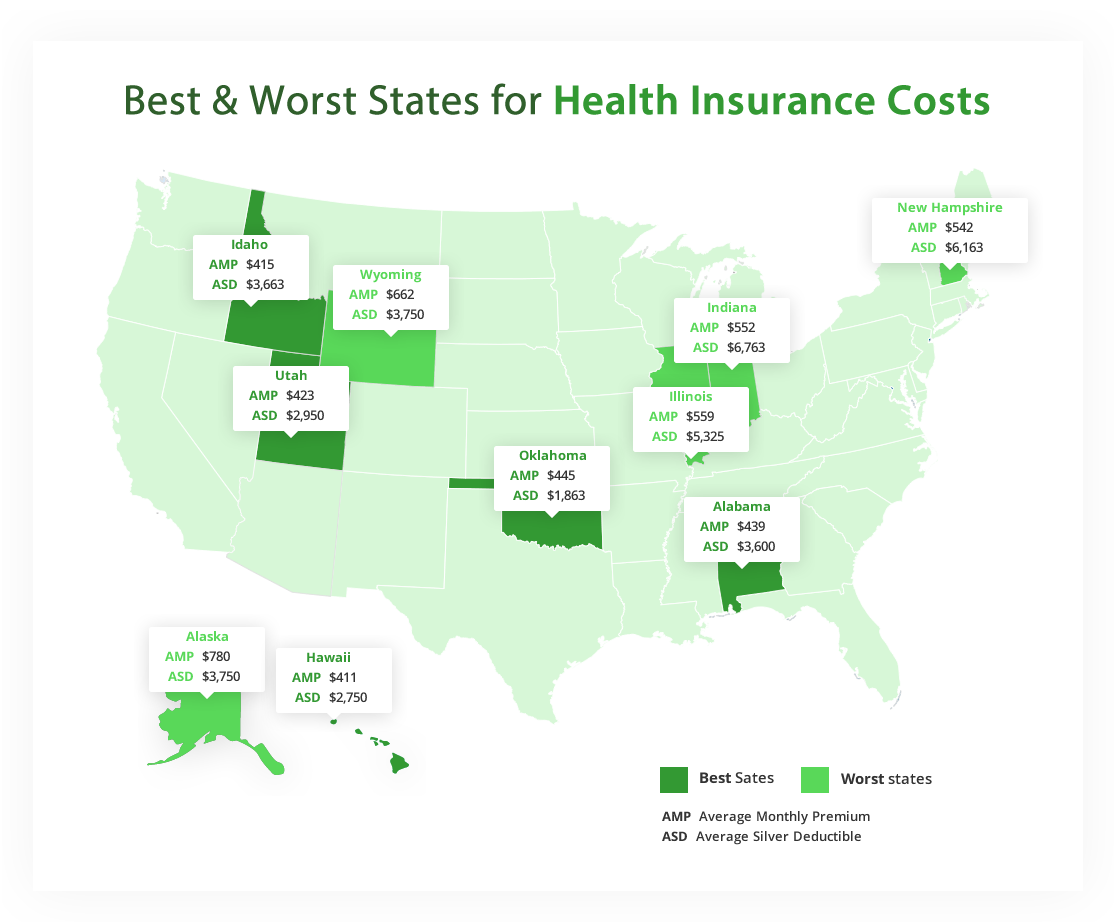

However, if you’re an independent contractor or your workplace simply doesn’t offer group health insurance plans, you would opt for individual health insurance. This simply means that the responsibility of finding a health insurance plan that matches you and your family’s medical needs rests solely on you. Once you research, compare, and find the right plan, you’re also responsible for enrolling during the Open Enrollment period that occurs at the end of each calendar year. The good news for Alabama residents is that your state is one of the best-ranked when it comes to affordable and high-quality health insurance coverage.

Because of the various terms, it can be a little confusing to navigate health insurance plan types versus health insurance metal tiers. Metal tiers simply refer to the level of coverage you’re responsible for.

Under the ACA, also known as “Obamacare,” plans have to have a minimum coverage of 60%, give or take a percentage or two either way. Health insurance in Alabama follows the same system as the rest of the country:

Bronze

Have the lowest premiums but also feature high out-of-pocket costs. This works if you’re young or in relatively good health and don’t anticipate needing frequent medical care.

Silver

A balance between affordable premium and manageable out-of-pocket costs. In Alabama, the cost of CSR has now been added to Silver plans, which means that, depending on your medical care needs, you may find Bronze and Gold plans to be better value for your money

Gold

Typically used by individuals who are older and will need frequent access to medical care. You’ll pay higher premiums, but your deductibles are comparably lower.

Platinum

Offering the very highest level of coverage — up to 90% — while you pay 10%. However, Platinum plans also have the highest premiums.

Catastrophic

Technically, this option is only available to individuals younger than 30 years of age. However, it’s worth noting that you can apply for Catastrophic plans in Alabama, regardless of your age, if you qualify for a hardship exemption. You won’t qualify for any premium tax credits, however.

In Alabama, there are three popular types of healthcare coverage you can opt for. These include:

Individuals who choose HMOs for their healthcare coverage will enjoy having to deal with little to no paperwork. HMOs are a close-knit healthcare management system that consists of primary care physicians, referral-based specialists, and hospitals who have agreed to participate as part of one network. Costs are also generally lower for HMOs.

You can choose from a larger network of doctors and hospitals with a PPO, and you won’t need to get a referral to see a specialist. You can also see a doctor outside of your network and be reimbursed for some of the costs. However, this flexibility also means more paperwork on your end.

POS plans combine the best of PPOs and HMOs. With a Point of Service plan, you can choose your own doctor, without having to be responsible for as much paperwork as with a PPO. You’ll need to pay a portion of the bill up front and file a claim to be reimbursed later. However, POSs offer individuals the highest degree of flexibility when it comes to choosing your doctors and specialists.

2) Short-Term Medical (STM)

If you’re not currently in a position to gain access to or benefit from ACA-compliant health plans, you can always opt for short-term health insurance in Alabama. ACA plans are also known as “QHP” or “Qualified Health Plans.” Short-term insurance, while equally as viable an option, is known conversely as non-qualified.

This simply means that, unlike Obamacare plans, short-term insurance providers are under no obligation to cover all 10 essential health benefits. Short-term plans do not cover maternity, mental health, substance abuse or pre-existing conditions. You must also answer a set of medical eligibility questions to qualify for coverage — and that is not something ACA-compliant plans are allowed to do.

Opt for short-term insurance coverage in Alabama if you meet the following criteria:

- You’ve missed the Open Enrollment period and need a healthcare plan for the rest of the year, until Enrollment reopens.

- You need an affordable alternative to an ACA plan. In Alabama, continuous coverage under short-term health insurance is available for up to 36 months

- You’ve recently lost your job and access to group health insurance, and you need a bridge to see you through, until you can get qualified health insurance

- You’re a recent college graduate who no longer qualifies for coverage under your parents’ plan, and you need coverage while you look for a job

- You’re planning on living abroad for 330 days (or 12 months), and you’re otherwise uninsured

- You’re not yet a U.S. citizen but you are considered a “lawfully present” immigrant or “qualified non-citizen.” You can buy private insurance while you wait for your immigration status to change, and this can be renewed annually for up to 36 months (three years) in Alabama.

Applying for Health Insurance in Alabama

Once you know the kind of plan you’re looking for, your next step is to do research about the providers and plans available to you in the Marketplace. You will also need to gather application documents for enrollment. If you’re an immigrant, your documentation requirements differ from U.S. citizens living in Alabama.

If you’re a U.S. citizen living in Alabama, make sure you have the following documents ready for your Marketplace application:

- Information about your household

- Home and mailing address for everyone applying

- Basic information about everyone applying and their relationship to you

- Social security numbers for everyone applying

- Tax information such as filing separately or jointly, and any dependents

- Employer and income information

- An estimate of household income

- Information about anyone currently covered, including Medicaid, CHIP, Medicare, VA health care, etc.

At ihealthagents.ahix.com, we streamline the health insurance research and selection process for you. Our specialized agents can help guide your decisions with personalized advice over the phone or through our chat feature. Use our extensive platform to find the right plan and healthcare coverage for you, and harness our easy enrollment process to keep yourself and your family medically covered. Learn more about how iHealth Agents is making affordable healthcare in Alabama even more accessible to you.

Find the Right Plan Today

If you’re trying to stay within budget while finding the right coverage, then you already know that it can be an overwhelming process. The good news is that iHealth Agents can do the work of searching for the right plan for you. iHealth Agents is an affordable exchange where you can browse for qualified and non-qualified plans so you can find the right coverage at the right price. Find your new policy today.